What Rate Are You Waiting For?

There’s no denying that we’ve been on a wild ride this year with mortage rates.

Let’s take a look in the rearview mirror first. FreddieMac’s PRIMARY MORTGAGE MARKET SURVEY®

The week ending 5/2/2024 marked the highest rate for 2024. 30 Year rates averaged 7.22%, while 15 Year rates averaged 6.26.

Year end 2024 landed with 30 Year rate average of 6.85% and 15 Year rate average of 6.00%.

Where Are We Now & What Rate Are You Waiting For?

The 30-year fixed-rate mortgage averaged 6.18% as of December 24, 2025.

The 15-year fixed-rate mortgage averaged 5.50%.

We have heard from many buyers and sellers that the rate they are waiting for

NEEDS TO START WITH 5.

If everyone is waiting for that magic number 5, we know what will happen. There is pent up demand that buyers have right now as well as homeowners who are ready to sell but are on hold because their next purchase will be at a higher interest rate than what they currently have.

This all makes sense except here’s what will really happen: MULTIPLE OFFERS, OFFERS ABOVE LIST PRICE, AND BUYERS’ LOSE THEIR NEGOTIATING POWER!

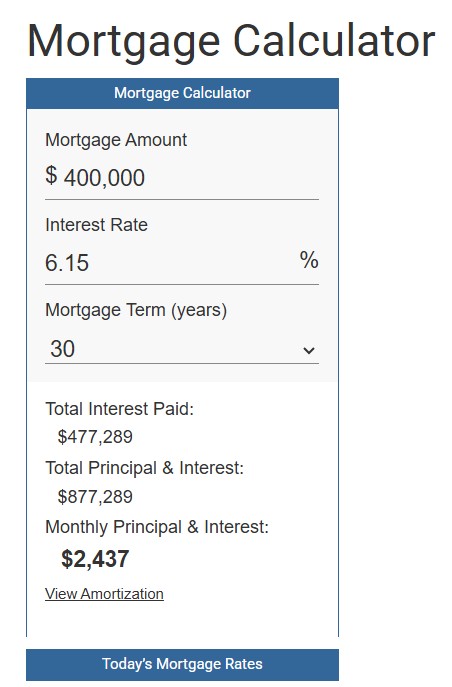

YOU COULD PAY A HIGHER PRICE WHICH MEANS ALTHOUGH YOU SNAGGED A LOWER INTEREST RATE YOU END UP PAYING MORE! Here are examples on a $400,000 mortgage.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link